Welcome to thepaydayking.com

What is a personal loan?

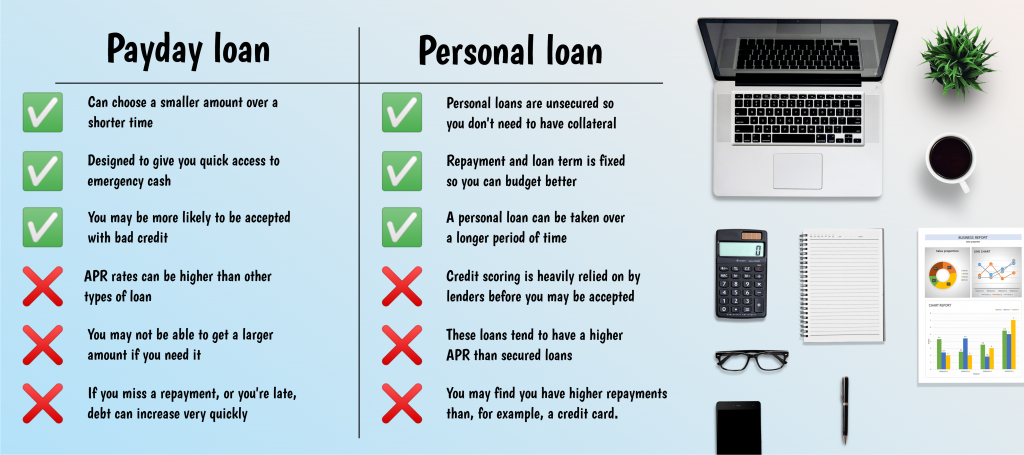

What are payday loans and personal loans? A personal loan is an exact amount of money repaid over a set amount of time. In essence, you would pay back a set amount every month, including interest, until the debt is settled.

Personal loans are also known as unsecured loans, a type of installment loan, because you don’t need to secure it against something valuable that you own, such as a car or your home.

How do they work?

A lender will look at your application and then consider your income and any existing debt and outgoings. Based on this, a decision will be made about how much you can borrow and over how long.

Interest rates are usually fixed, so you know exactly how much you will pay every month.

To consider

- Personal loans can have higher than usual interest rates rather than loans secured against something which could be dependent on your credit score. You can easily check your credit score on websites like Experian.

- Credit scoring is heavily relied on by lenders due to the fact that it is only a ‘promise’ to pay it back; they wish to see that you are good at repaying debt.

- It is worth acquainting yourself with the various aspects involved in borrowing from different lenders. This will include APRs, loan lengths, T’s & C’s, and repayments.

- Ensure you only borrow what you can comfortably afford to pay back every month, or you may find yourself in financial difficulties and with a negative credit score.

Benefits

- These loans are easier to budget for as there is a set repayment.

- Personal loans generally have a fixed rate (but it can vary, so double check first).

- Although it may extend your loan’s terms, you can consolidate other debts into a personal loan. This means just one repayment to one lender.

- Personal loans can have a lower APR than credit cards if there is a large outstanding balance.

- You may be able to borrow more than a set credit card limit.

Payday loans – Payday and personal loans comparison

What is a payday loan?

Payday loans, like installment loans, are high-cost, short-term loans that are often paid back over 1-6 months and have a loan value of $300-$2500. Like installment loans, payday loans are helpful if you are experiencing an emergency bill or payment that must be paid within a few days or weeks. Payday loans allow you to spread this cost over a short period. Direct lenders can provide funds for your payday loan, usually within an extremely short amount of time – often within 1 or 2 business days!

How does it work?

If your payday loan or personal loan application is accepted by a lender, you will be required to pay back the agreed amount in the contract, including interest, on the date agreed, directly from your bank account. They are useful when dealing with emergency or unexpected bills, such as auto repairs, Medical Expenses, Wedding Expenses, Home Improvements, and Vacations.

To be considered (negative points/risks)

- APR rates can be very high with this type of loan.

- Some payday lenders can fall exempt from some state laws that limit interest rates. Some states have few restrictions, and some states outlaw payday loans completely.

- Ensure you can repay the amount you borrow on your next payday, or you could end up in a spiral of borrowing and debt.

Benefits

- These short-term loans can help your choices regarding spending that may otherwise not apply.

- They can be used for borrowing a small amount over a short period of time rather than a bad credit loan which may tie you in for longer.

- They are designed to give you quick access to the money you need.

Ready to get started? Get a free quote HERE.

Key facts about Payday Loans

- Payday loans are for people with poor credit – this is not true. Payday Loans are for everyone who needs a cash advance, to help them through to their next payday

Can I obtain a small online payday loan?

- Searching online for small payday loans for bad credit is the best way to find your loan. We can help search to find you the right loan.

How will I repay my payday loan?

- Terms and conditions can vary from state to state. However, you should be able to pay off your loans on your next paycheck. you will need to check the Terms you are given with the loan you are offered.

When can I apply for a payday loan online?

- Payday loans can be very useful in an emergency, such as you need to pay an unexpected bill or a car’s tire change.

- A payday loan is recommended if you can pay off the full loan amount plus fees within the next payday.

- You can apply for payday loan online 24 hours a day, 7 days a week.

Requirements – apply for an online payday loan.

- The minimal requirements for online payday loans can vary from lender to lender, also by State. We recommend you look at the qualifying criteria for each State.

You might find the best payday loans online here at PDK. You could create an emergency fund instead of quick payday loans. Learn more about budgeting and saving tips – click here.

Live frugally and save more money to create an emergency fund instead of getting a personal loan.

What is the maximum loan amount for PaydayKing loans?

At Payday King you can borrow up to $2500, that can be any amount form $100 such as

- 500 Dollar Loan

- 1000 Dollar Loans

- 100 Dollar Loans

Is an online payday loan better than an installment loan?

Payday Loans vs Installments loans

If you have an expected bill or emergency and you desperately need quick cash Payday loans for poor credit and online installment loans can help you to get right on track.

Differences:

Terms and Conditions can vary from lender to lender.

Repayment period:

- payday loans must be paid the next payday.

- Installment loans have a more extended repayment period.

Payday King offers online payday loans.

Paydayking is aware of how things can get tricky sometimes and how important it is to get the money you need when you need them the most.