Welcome to thepaydayking.com

How To Boost Your Credit Score By Spending

If you have a low credit rating or never had credit, it can be hard to get accepted for a loan or other credit. Given that maintaining a high credit score is of enormous benefit… how can you boost your credit score by spending?

A credit score, on the whole, is a figure that tells lenders how responsible you are when managing debt. There are three major credit bureaus here in the US; Experian, Equifax, and TransUnion and each compile a report using your financial information to show lenders your level of creditworthiness.

Scores can range from 300 to 850. In short, the higher your score, the better. A ‘good’ credit score averages 670 – 739, according to FICO, a data analyst specialist focusing on credit scoring.

Your credit score could be checked for a variety of reasons, from a new cellphone contract, a personal loan or student loan, and even a mortgage.

Factors of your credit score

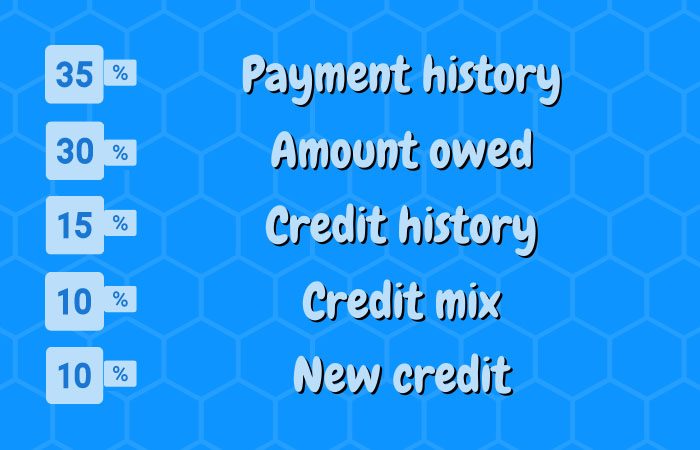

To help explain more, your credit score is based on a number of things that are allocated a percentage. The most important factor on your credit file is your payment history accounting for 35% of your score. In view of this, any defaults have a considerably negative impact on your score. That is to say, if you’ve missed repayments or been late, this will show on your credit report. It could even stay on there for a few years!

30% of your score is dedicated to the amount you owe. In particular, the more you owe compared to your salary income (aka debt to income ratio), the lower your score. If you only repay the minimum each month, it could show lenders that you struggle to repay debt.

Your credit history accounts for 15% of your overall score. Long-standing, well-managed active credit accounts show lenders that you are reliable and manage debt well.

In addition to the above percentages, 10% stems from the types of credit you have. For example, lenders like to see a mix of revolving credit (credit cards, etc) and installment credit (fixed repayment loans, etc). Managing this mix of credit capably can boost how you are perceived by lenders.

The final 10% of your credit report is newly opened lines of credit. Lenders don’t like to see multiple new accounts opened over a short space of time because it doesn’t show them that you can repay your debt well over time and can make you look desperate.

Now that we have an idea of how a credit score is developed and recognized, you may have a clearer idea as to why never having had credit can make it difficult to actually get credit.

You owe nothing to anyone. That’s great! Right? Unfortunately, this also means that lenders cannot see how competent you would be at repaying money if you did actually owe any.

If you have a low or bad credit score due to missing a repayment or have a high credit utilization ratio, lenders will not have a favorable view and interest rates may be higher or they may even decline credit outright.

Credit Utilisation

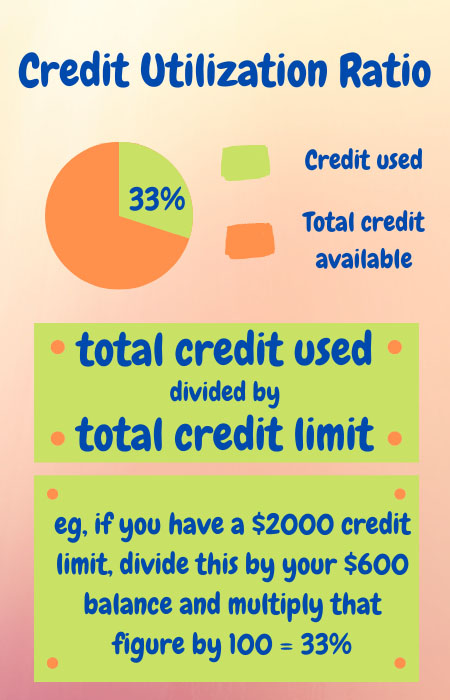

Lenders ideally prefer to see 30% or less of your total credit limit being used at any time. It is determined by dividing the total of your credit card balances by the total of your credit card limits set by your credit card companies.

For example, if you have one credit card with a limit of $2000 and you currently owe $1000 on the balance, you are using 50%. If you owe $100, you are only using 5%. Keeping a lower balance always works in your favor, for instance, aim for approximately $600 or less in this example.

Therefore, with all this in mind, how can we actually spend money to increase our credit score?

First of all, we’re not talking about blowing a few hundred dollars on a shopping spree and getting praised for it. If only we could! Rather, it’s all about exactly what you spend your dollars on.

One example is that you may find it easier to get a larger secured loan, such as an auto loan, as opposed to a smaller unsecured loan. A lender has more guarantee with a secured loan of getting money back if you default on the loan; they can sell the car to recuperate any outstanding finance. This may make them more likely to lend to you and builds your credit history by showing that you make regular repayments over a set period of time.

By the same token, it doesn’t have to be a car loan, it could be a big furniture purchase. Just ensure that whichever organization lends you the money will report to one of the three credit bureaus. If not, it will all be in vain if other lenders cannot see how capable you are of managing repayments.

Consider getting a store credit card. Another (sensible) credit limit can raise your utilization ratio, providing you keep a balance. Pay it off in full every month if you can and lenders will begin to see you manage debt well. It also helps with the credit ratio mix, adding a line of revolving credit.

In the same way, a secured credit card can help you raise your credit score. With this method, you simply pay some money onto the card and this becomes your ‘credit limit’. As you use the card for a purchase, you merely top it back up to the credit limit monthly. Lenders will see that you can make regular on-time payments and it boosts both your credit ratio and your credit score, over time.

Simply paying more off your balances each month rather than using the cash for unnecessary purchases will also easily begin to build your rating.

Do you have someone very close to you with a good credit history and a high credit limit? If you do, ask if they would consider adding you to one of their accounts as an authorized user. The account owner doesn’t even have to let you use the card for you to see a small improvement in your credit score. The account’s beneficial payment history is merely added to your credit report and produced into your score.

There are other things to consider too. Keep any credit card accounts open, even if you are not using them because this improves the utilization ratio; that is to say, you have credit available to you that you aren’t using which is seen favorably.

A small loan over 2/3 months, if accepted, can show that you can repay in full and on time. The PaydayKing has a panel of lenders that may be able to help you out here.

Make as big a payment as you can comfortably afford each month, and pay any balance in full where you can. Even overpaying small amounts during the month (micropayments) will help your credit score because you are showing positive credit behavior. And most importantly, don’t be late or miss any repayments. Defaults can be on your record for up to 7 years.

Regularly monitor your credit report and inform the credit bureaus if there are any mistakes on there or outdated information. These should no longer be on your file. Fraud can affect your credit score so use Notty to see if you are at risk.

As the old saying goes “Rome wasn’t built in a day” and neither will you fix a low or poor credit score in that time, sadly. Keep up with your repayments, overpay where possible, and budget well. It will take time and dedication but the impact is well worth it for your future. Those three numbers can have a huge influence on your future and you can make that good or bad!